The shift from traditional Internal Combustion Engine (ICE) to Electric Vehicles (EVs) is a pivotal moment for the Detroit region.

The Detroit Region has a great deal at stake, given its robust automotive industry presence. However, specialization in automotive does not ensure success in future mobility applications as EVs will require new technologies and supply chains. The EV production process and techniques differ vastly from ICE, requiring varying suppliers, fewer production workers, and different R&D specializations.

These new processes pose a risk to the Detroit Region, as it is entrenched in traditional automotive production. While the Detroit Region boasts one of the most suitable labor forces for mobility-related jobs in production and R&D, adaptation is required for Detroit to maintain its automotive presence and branch out into future mobility.

The Global Epicenter for Mobility (GEM) identified a broad new mobility cluster comprising several industries and over 250 North American Industry Classification System (NAICS) codes.

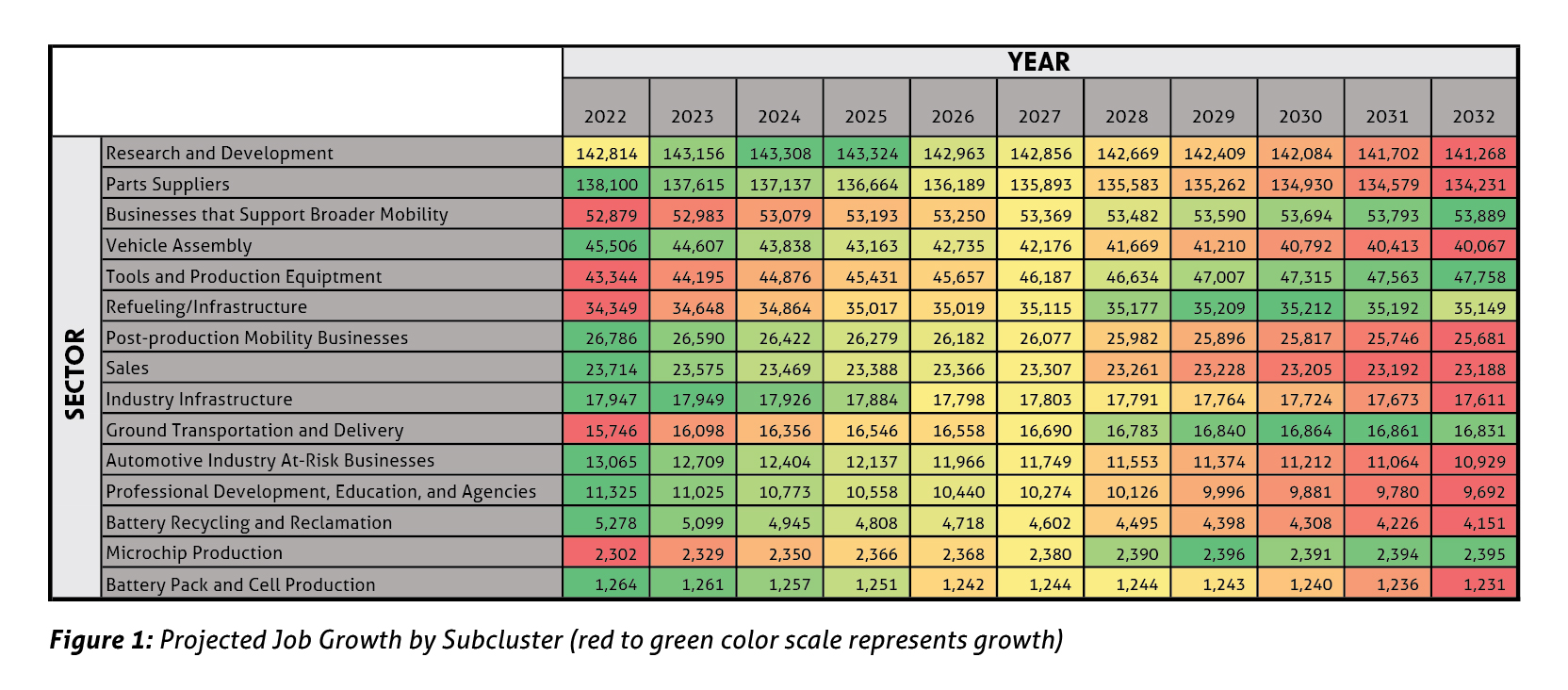

Due to the nascency of future mobility technologies, like EVs, autonomous vehicles (AVs), and unmanned aerial vehicles (UAVs), the new mobility cluster had previously been largely undefined. Identifying the industries relevant to future mobility led to the use of over 250 NAICS classifications. The NAICS classifications were grouped into the following mobility subclusters and are ranked ordered in the importance of jobs created:

- Research and Development

- Parts Suppliers

- Businesses that Support Broader Mobility

- Vehicle Assembly

- Tools and Production Equipment

- Refueling/Infrastructure

- Post-production Mobility Businesses

- Sales

- Industry Infrastructure

- Ground Transportation and Delivery

- Automotive At-Risk Businesses

- Professional Development, Education, and Agencies

- Battery Recycling and Reclamation

- Microchip Production

- Battery Pack and Cell Production

Several of these clusters present growth opportunities as the age of future mobility dawns. R&D, suppliers, businesses that support broader mobility, and vehicle assembly are some of the most significant sectors for the Detroit Region, as they account for over 300,000 jobs (see Figure 1). Compared to the rest of the country, the Detroit Region has many R&D jobs critical to future mobility, like mechanical and software engineers.

However, projections indicate little growth across these sectors. Additionally, automation threatens automotive at-risk jobs like production, operation, and repairs, which may phase out their need. Stagnating job growth and skillsets phasing out demonstrate the need to retain talent relevant to future mobility and retrain the current workforce at risk of outdated skills.

Future mobility jobs, like battery production, microchip production, and battery recycling, have yet to grow significantly in the Detroit Region. These subsectors account for less than 10,000 regional jobs and project no growth. Due to their interconnectedness with EV production, their presence is pivotal to attracting industry investment. Despite the lack of projected growth, Detroit has attracted startups like energy storage technology company Our Next Energy.

indicating the region’s competitiveness in attracting future mobility investment. As future mobility continues to grow, the regions highly specialized in these sectors should attract investments and retain a foothold on jobs. A strategy to attract investment and jobs from a concentration of specialized EV suppliers will be critical for the Detroit region to remain the Global Epicenter of Mobility.

A diverse workforce is critical when positioning Detroit’s competitiveness in future mobility.

An industry-wide focus on diversity has guided recent investments as mobility companies have cited workforce diversity as a primary consideration when determining the best regions for their future mobility facilities. In the Detroit Region, females average around 20% of the mobility-related workforce and only 11 out of 38 mobility-related occupations have over 25% female representation. Only one profession, buyers and purchasing agents, has over 50% female representation. Nevertheless, there are promising trends of more females entering engineering and managerial roles, which should only increase in future mobility applications.

Of the 38 identified mobility-related occupations, 23 have a racially diverse workforce of at least 25%. While the Detroit Region’s mobility-related jobs are comparatively strong regarding racial diversity, there is still room for improvement compared to other mobility-focused regions. The Detroit Region can build upon gender and racial diversity through regional initiatives that empower minority and women-owned businesses. Proper coordination and collaboration with regional accelerators and support organizations dedicated to diversity can help the mobility industry achieve a more diverse workforce.

Efforts across the country serve as examples for the Detroit region in accelerating momentum in the mobility industry.

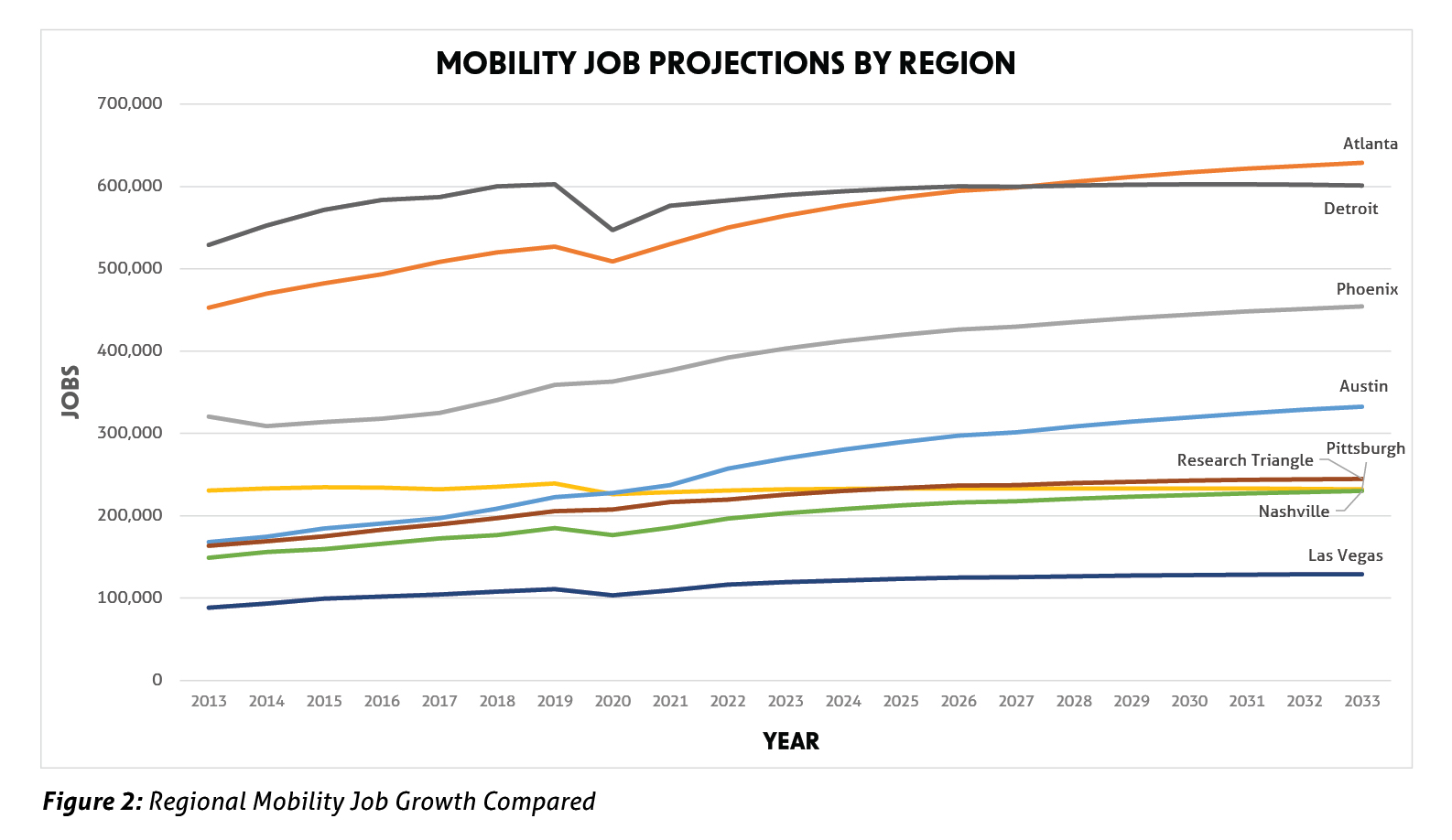

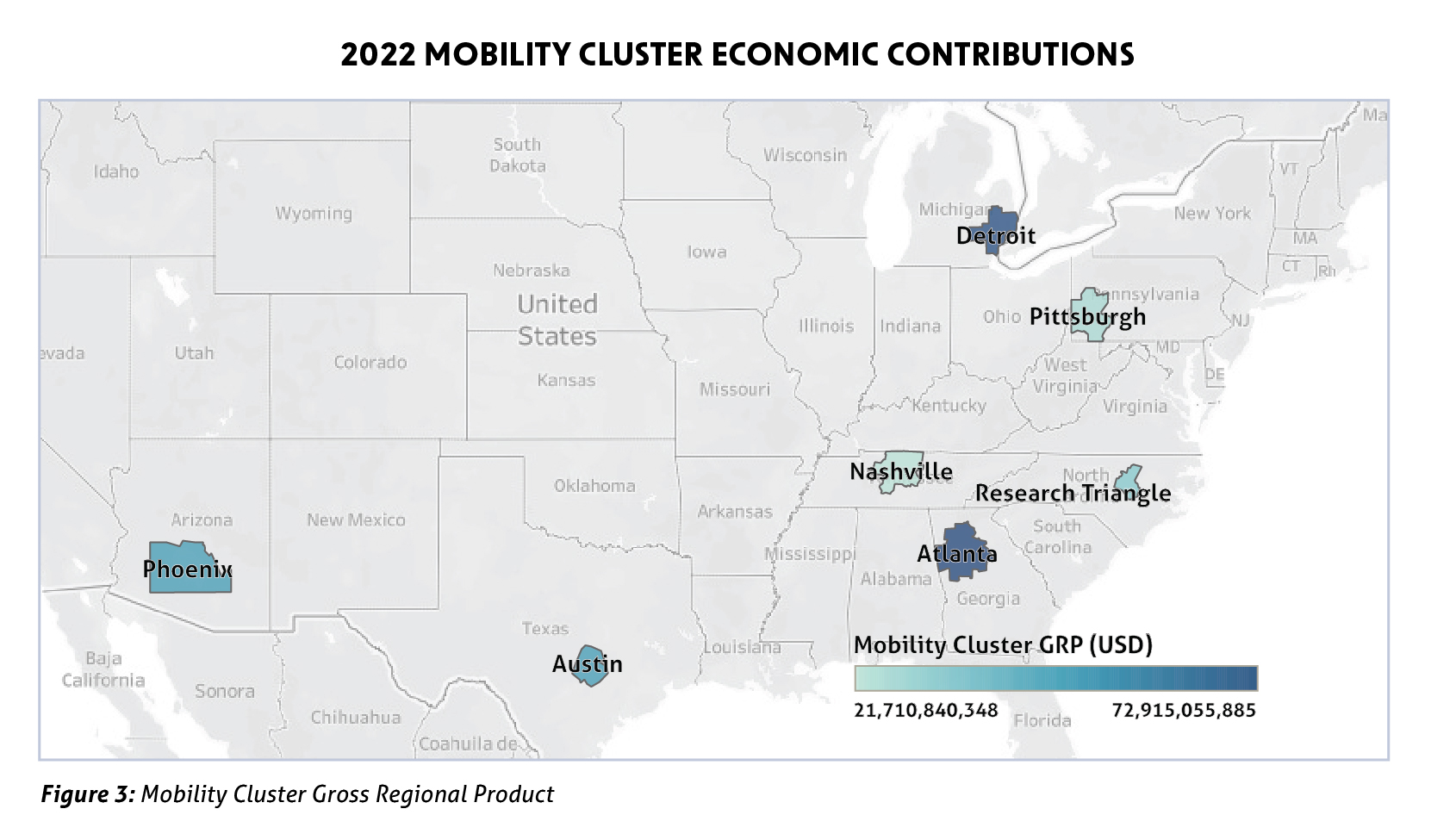

Regions like North Carolina’s Research Triangle, Phoenix, Las Vegas, Austin, Pittsburgh, Atlanta, and Nashville are all examples of regions that have used varying initiatives to bolster economic and job growth in the mobility sector (see Figure 2).

As Detroit faces national competition for mobility-related jobs, several regions are utilizing different approaches to position themselves as leaders in mobility. Key determinants cited are:

- Educational institutions

- Public Private Partnerships

- Investments – from tech/auto companies

- Infrastructure – hard and wired

- Talent – development, recruitment

- Local Expertise

- Startup Community and Entrepreneurial Ecosystem

Atlanta has the closest regional job count and Gross Regional Product (GRP) to Detroit when looking through the scope of the future mobility cluster (see Figure 3). Projections show Atlanta surpassing Detroit by the middle of the decade in terms of jobs and having already surpassed it in terms of GRP. Atlanta and Georgia, broadly, have received a high volume of electric vehicle investment over the last few years. Their strengths include a healthy university presence, concentrated public-private partnerships, a diverse talent pool, and a prosperous startup ecosystem. Their universities contribute to Atlanta’s collection of diverse professionals with the highly technical skills required for EV and mobility-related jobs. Atlanta’s public-private partnership’s ability to couple this talent pool with incentives for established companies and startups has served the city well in its goal to bring more mobility jobs to its region.

The Bay Area, the Research Triangle, Boston, Austin, and Pittsburgh have also benefited from strong regional universities and a high level of technical acumen in their workforce. These regions have successfully leveraged VC funding to foster a startup community, having been supported through partnerships that stimulate innovation. The Research Triangle specifically was the home of aging textile and tobacco industries and made a concerted effort to promote startups and entrepreneurship. Accelerators have worked to transform the region into a Southern powerhouse for technology and innovation, becoming one of the best areas for startup success.

Another consideration is infrastructure’s effect in attracting mobility and tech jobs. Infrastructure development has benefited cities like Pittsburgh, where an incentive-based strategy proved unsustainable on its own, leading to a more community-based approach.

Because of investments in infrastructure and creating a cleaner city, companies like PNC Bank were interested in expanding their Pittsburgh operations. This approach ultimately led to Pittsburgh’s first population growth in 50 years. Current regional initiatives to bolster infrastructure and support mobility-friendly infrastructure should help the Detroit Region bridge the gap between its contemporaries.

For the Detroit Region to maintain its regional dominance, it must use these examples of how its counterparts have used factors like education, talent, infrastructure, partnerships, and startup culture to promote investment. Detroit already has strengths in these areas and unparalleled local expertise in mobility. However, if Detroit wants to distance itself from the rest of the country, measures to boost all these categories could assure preeminence in the mobility industry.

A survey during the project’s initial phase attempted to uncover gaps in the mobility space.

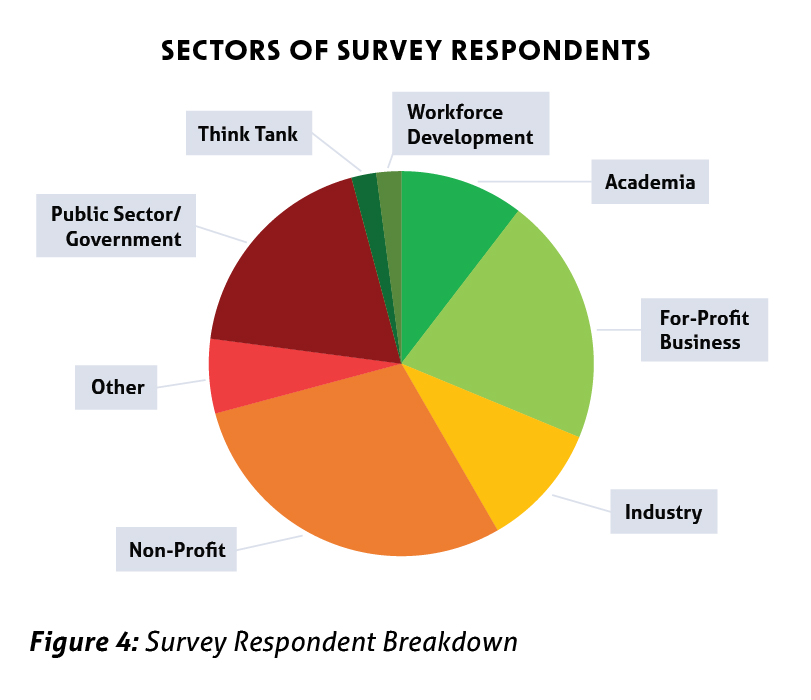

The survey solicited input from academia, for-profit businesses, industry, non-profits, think tanks, and workforce development (see Figure 4). The survey asked questions regarding the mobility industry’s collaboration, innovation, proving and testing, site readiness, talent, and ability to transition legacy companies.

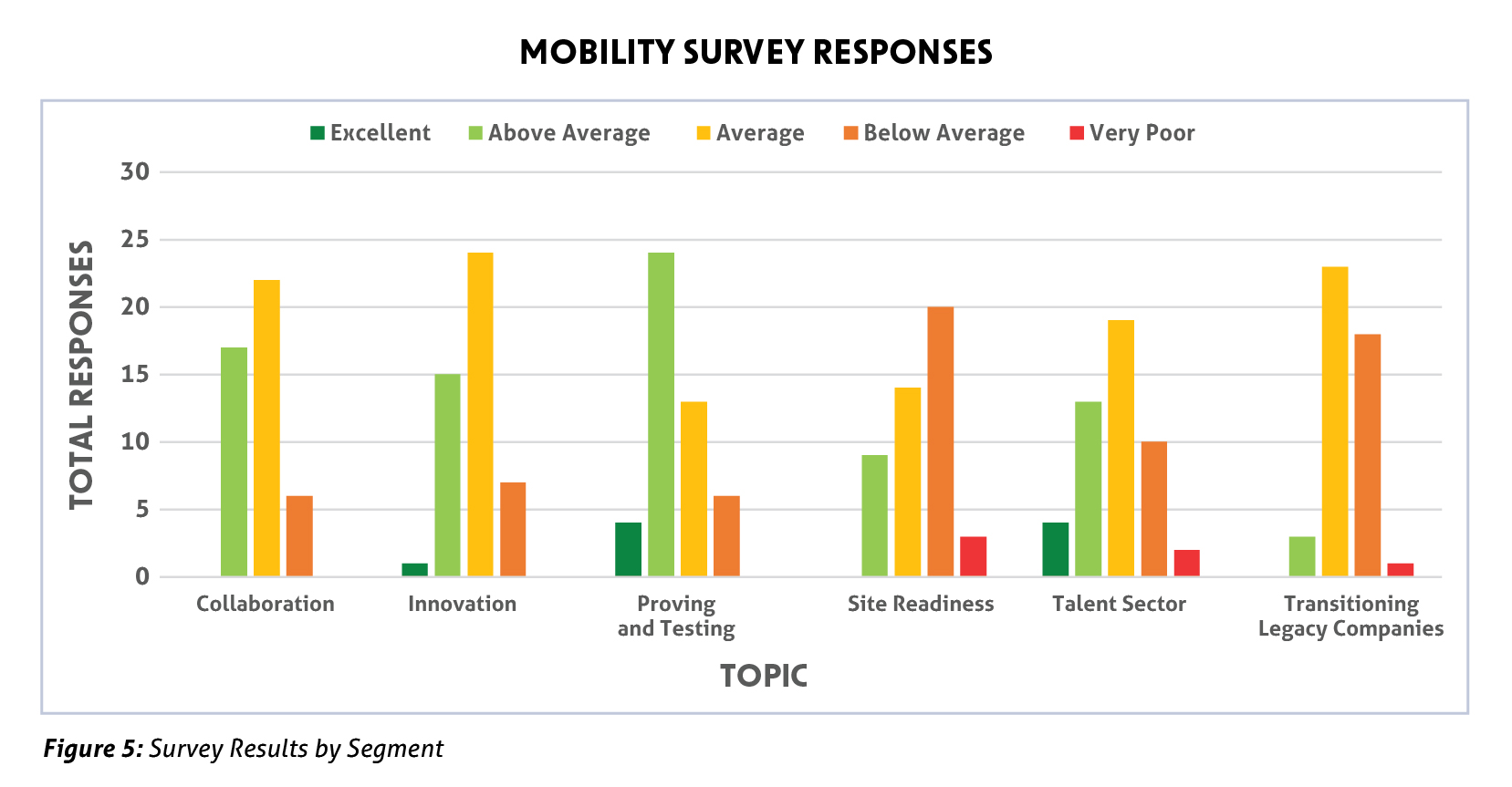

The results were similar for most of these topics, with respondents viewing these segments in the range of below-average to above-average (see Figure 5). The issues that generally illicit most average to positive feedback were innovation, proving and testing, and collaboration. The talent segment garnered mixed reviews, with a large group selecting this area as average. The topics that respondents viewed as needing improvement were transitioning legacy companies and site readiness.

While some of these segments lag more than others, there are potential improvements in all facets. These responses are a starting point when developing plans to improve each component as the Detroit region adapts for future mobility.

The Detroit region is a pillar of the automotive industry and, with proper adjustments, will become globally recognized as the global epicenter for mobility.

With the right partnerships and workforce training, Detroit should work to retain its R&D jobs and transition its at-risk jobs to grow its unrealized potential in future mobility jobs, like microchips, batteries, and recycling. The mobility sector can also improve diversity by coordinating with its many regional associations dedicated to these causes. The Detroit Region can build upon its local expertise by learning from initiatives nationwide that led to mobility industry growth. These initiatives focused on infrastructure, education, talent, public-private partnerships, and a startup environment.

Lastly, the region should continue to listen to industry leaders through conversations, focus groups, and survey data on improving various facets of the mobility industry. The Detroit Region is a leader in automotive and possesses many advantages as other regions across the country attempt to lure in future mobility-related jobs. The Detroit Region should build upon its strengths and grow with the mobility industry as it pivots to the groundbreaking next phase.

Connect With Us To Learn More About Our Signature Programs

DRP’s research team ensures optimally targeted work of the GEM partners by informing stakeholders on the landscape of the mobility industry. These efforts by research include tracking a rapidly changing mobility environment, future-proofing efforts by GEM partners, and helping partners exceed their targeted objectives to maximize benefits to the region.

TO LEARN MORE ABOUT THE DETROIT REGIONAL PARTNERSHIP AND ITS SIGNATURE PROGRAMS, VISIT DETROITREGIONALPARTNERSHIP.COM

Go to DetroitRegionalPartnership.com

Go to DetroitRegionalPartnership.com